Investing can feel intimidating—especially when markets are volatile and headlines are full of uncertainty. Many people worry about the “right time” to invest, fearing they’ll buy at the top or miss out on the best opportunities. Fortunately, there’s a time-tested strategy that helps investors sidestep the stress of market timing: dollar-cost averaging (DCA). This approach is simple, effective, and accessible to anyone looking to build wealth consistently over time.

In this comprehensive guide, you’ll learn what dollar-cost averaging is, how it works, why it’s so powerful, and how you can put it into practice—no matter your experience level or investment goals.

What Is Dollar-Cost Averaging?

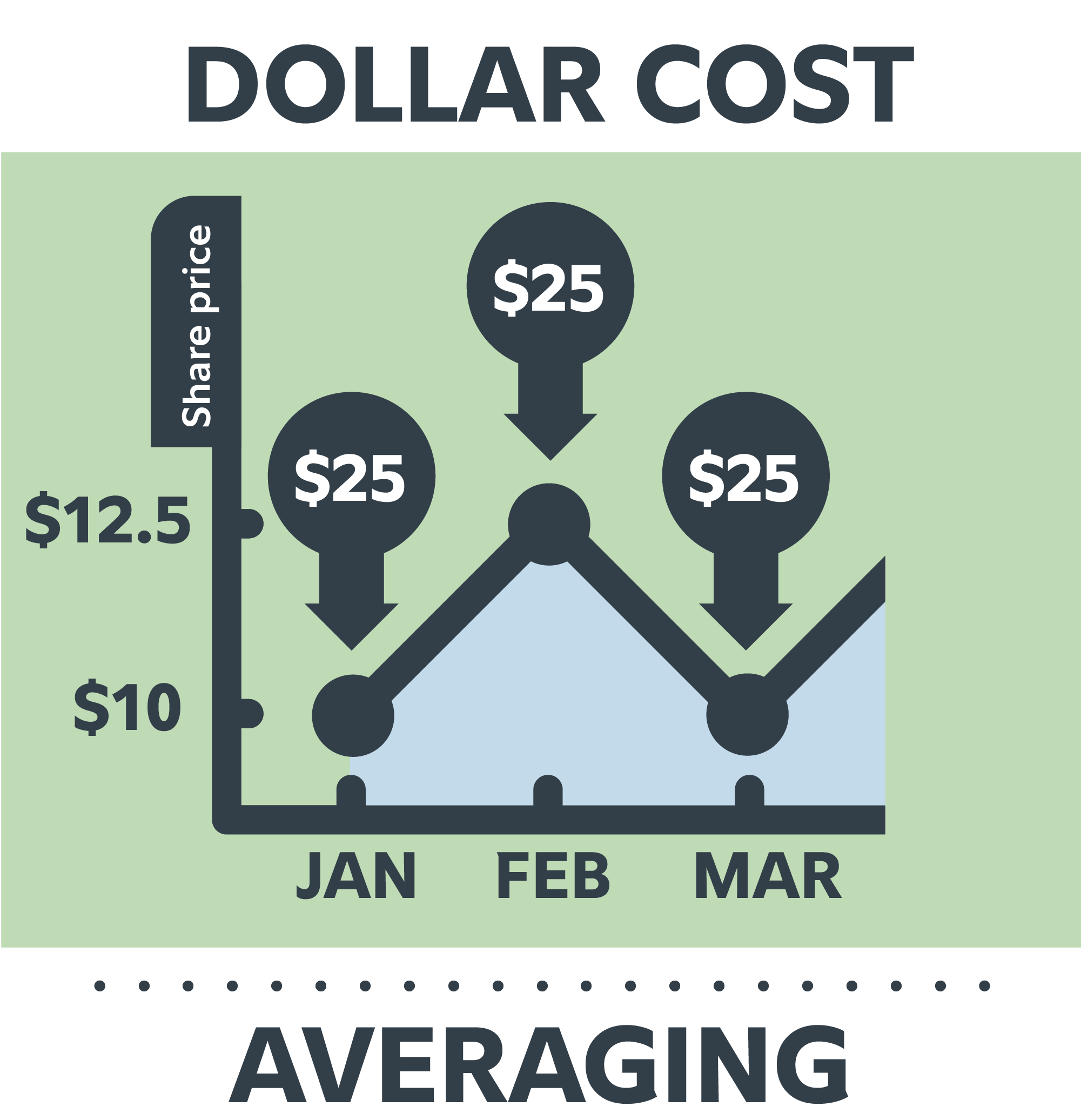

Dollar-cost averaging is an investment strategy where you invest a fixed amount of money into a particular asset (like stocks, mutual funds, or ETFs) at regular intervals, regardless of the asset’s price at the time. Instead of trying to guess the best time to invest a lump sum, you spread your purchases over time, buying more shares when prices are low and fewer when prices are high.

This systematic approach helps smooth out the effects of market volatility and can lower your average cost per share over the long term.

How Does Dollar-Cost Averaging Work?

Let’s break it down with a simple example:

Suppose you decide to invest $100 in a mutual fund every month. Some months, the price per share is low, so your $100 buys more shares. Other months, the price is higher, so you buy fewer shares. Over time, this strategy can result in a lower average cost per share than if you tried to invest all your money at once—especially if the market is volatile.

Real-World Example

Imagine an investor who puts $100 into an S&P 500 index fund every month for 10 months. The fund’s price fluctuates each month:

| Month | Amount Invested | Share Price | Shares Purchased |

|---|---|---|---|

| 1 | $100 | $10 | 10.0 |

| 2 | $100 | $12 | 8.3 |

| 3 | $100 | $8 | 12.5 |

| 4 | $100 | $11 | 9.1 |

| 5 | $100 | $9 | 11.1 |

| 6 | $100 | $10 | 10.0 |

| 7 | $100 | $13 | 7.7 |

| 8 | $100 | $8 | 12.5 |

| 9 | $100 | $9 | 11.1 |

| 10 | $100 | $11 | 9.1 |

Total Invested: $1,000

Total Shares Purchased: 101.4

Average Cost Per Share: $9.86

If the investor had invested the entire $1,000 during a high-priced month, they would have bought fewer shares. By spreading out the purchases, they benefit from market dips and reduce their

average cost.

The Key Benefits of Dollar-Cost Averaging

1. Reduces Market Timing Risk

Trying to time the market—buying low and selling high—sounds great in theory, but even professionals rarely get it right. DCA removes the pressure to predict market movements, helping you avoid poorly timed lump-sum investments.

2. Smooths Out Volatility

By investing regularly, you buy more shares when prices are low and fewer when prices are high. This helps you “average out” the cost of your investments over time, reducing the impact of short-term market swings.

3. Encourages Consistent Investing Habits

DCA promotes discipline. By automating your investments, you build wealth steadily and avoid the temptation to make impulsive decisions based on emotions or news headlines.

4. Accessible for All Budgets

You don’t need a large lump sum to start investing. DCA lets you begin with small, regular contributions—perfect for new investors or anyone on a budget

5. Takes Emotion Out of Investing

Fear and greed can lead to poor investment decisions. DCA’s systematic approach helps you stick to your plan, even during market turbulence, by removing emotional reactions from the equation.

How to Implement Dollar-Cost Averaging

1. Choose Your Investment

DCA works best with investments that fluctuate in price, such as stocks, mutual funds, or ETFs. It’s less effective with assets that remain stable or trend only in one direction

2. Set Your Investment Amount and Frequency

Decide how much you want to invest and how often—monthly, biweekly, or even weekly. Many people align their investment schedule with their paycheck for convenience.

3. Automate Your Contributions

Most brokerages and retirement plans allow you to set up automatic transfers. This ensures you stick to your plan and invest consistently, regardless of market conditions.

4. Stay Committed for the Long Term

DCA is most effective when you stick with it through both rising and falling markets. Over time, you’ll benefit from the strategy’s ability to lower your average cost and build wealth steadily.

Dollar-Cost Averaging in Action: 401(k)s and Beyond

One of the most common examples of DCA is a workplace retirement plan, such as a 401(k). Employees contribute a fixed percentage of their paycheck to their retirement account every pay period, regardless of market conditions. Over decades, these regular investments can grow into a substantial nest egg, thanks to compounding and the smoothing effects of DCA.

You can also use DCA in IRAs, taxable brokerage accounts, or even dividend reinvestment plans (DRIPs), making it a versatile strategy for any investor.

Dollar-Cost Averaging vs. Lump Sum Investing

A common question is whether it’s better to invest all your money at once (lump sum) or spread it out using DCA. Historically, lump sum investing has often produced higher returns—especially in rising markets—because more money is working for you sooner. However, DCA can be a better fit if:

- You’re worried about market volatility or a potential downturn.

- You want to avoid the risk of investing a large sum right before a market drop.

- You’re building your investment portfolio gradually, as you earn income.

DCA is not about maximizing returns, but about managing risk and building consistent investing habits.

Who Should Use Dollar-Cost Averaging?

DCA is ideal for:

- New investors who want to start building wealth but are unsure about market timing.

- Long-term investors who want a disciplined, low-stress approach to investing.

- Anyone with a regular income who prefers to invest smaller amounts over time.

It’s less suited for investors with a large lump sum who are comfortable with risk and want to maximize returns in a rising market.

Dollar-Cost Averaging in Different Market Conditions

- Bull Markets: DCA may result in a higher average cost per share than lump sum investing, but it still encourages consistency.

- Bear Markets: DCA shines during downturns, as you buy more shares at lower prices, positioning yourself for gains when the market recovers.

- Volatile Markets: DCA helps smooth out the ups and downs, reducing the stress of short-term fluctuations.

Common Dollar-Cost Averaging Frequencies

You can tailor your DCA plan to your needs and cash flow:

- Daily: Rare, but possible for very active investors or with certain apps6.

- Weekly: Good for those paid weekly or who want to capture more price swings6.

- Monthly: Most common, aligns with monthly paychecks and budgeting6.

Choose a frequency that fits your financial situation and stick with it for the best results6.

Dollar-Cost Averaging: Pros and Cons

| Pros | Cons |

|---|---|

| Reduces market timing risk | May underperform lump sum investing in rising markets |

| Smooths out volatility | Not a guarantee against losses |

| Encourages disciplined investing | Less effective if markets trend only upward or downward |

| Accessible for all budgets | Can result in higher transaction costs if not automated |

| Takes emotion out of investing | Requires commitment and patience |

Practical Tips for Success with Dollar-Cost Averaging

- Automate your investments to ensure consistency and avoid missed contributions.

- Stay focused on long-term goals rather than short-term market movements.

- Review your plan annually to adjust your investment amount as your income grows.

- Combine DCA with diversified investments to further reduce risk.

Real-World Example: Joe’s 401(k)

Joe earns $1,000 every two weeks and allocates 10% ($100) to his 401(k). He splits this between a large-cap mutual fund and an S&P 500 index fund. Over 10 pay periods, Joe invests $500 in the S&P 500 fund. As the fund’s price fluctuates, Joe buys more shares when prices are low and fewer when prices are high. In the end, Joe’s average cost per share is lower than if he had invested the $500 all at once at a higher price.

Frequently Asked Questions

Is dollar-cost averaging always the best strategy?

Not always. Lump sum investing can outperform DCA in steadily rising markets, but DCA is valuable for managing risk, building habits, and reducing the stress of market timing.

Can I use DCA for any investment?

DCA works best with volatile assets like stocks, mutual funds, or ETFs. It’s less effective for stable assets like bonds or cash equivalents.

How do I get started with DCA?

Open an investment account, choose your asset, set your investment amount and frequency, and automate your contributions.

Does DCA guarantee profits?

No strategy can guarantee profits. DCA can help lower your average cost per share and reduce risk, but you can still lose money if the market declines over the long term.

Conclusion: Build Wealth Consistently with Dollar-Cost Averaging

Dollar-cost averaging is a simple yet powerful strategy for anyone looking to build wealth steadily and reduce the stress of investing. By investing a fixed amount at regular intervals, you sidestep the pitfalls of market timing, smooth out volatility, and develop disciplined investing habits that can pay off over the long run.

Whether you’re new to investing or simply want a reliable way to grow your portfolio, dollar-cost averaging can help you stay on track—no matter what the market is doing.

Ready to get started?

Choose your investment, set your schedule, and let dollar-cost averaging work for you. Your future self will thank you!

Leave a Reply